Indian Overseas Bank (IOB) is one of India’s leading public sector banks, offering exciting career opportunities through its Latest LBO Recruitment drives. The IOB LBO Recruitment process is designed to hire skilled professionals for the role of Loan Recovery Officers (LBOs), who play a crucial role in managing NPA (Non-Performing Asset) recovery and maintaining the bank’s financial health.

This guide covers everything candidates need to know about IOB LBO Vacancy, including eligibility criteria, selection process, application steps, and salary details.

IOB LBO Recruitment 2025: Overview

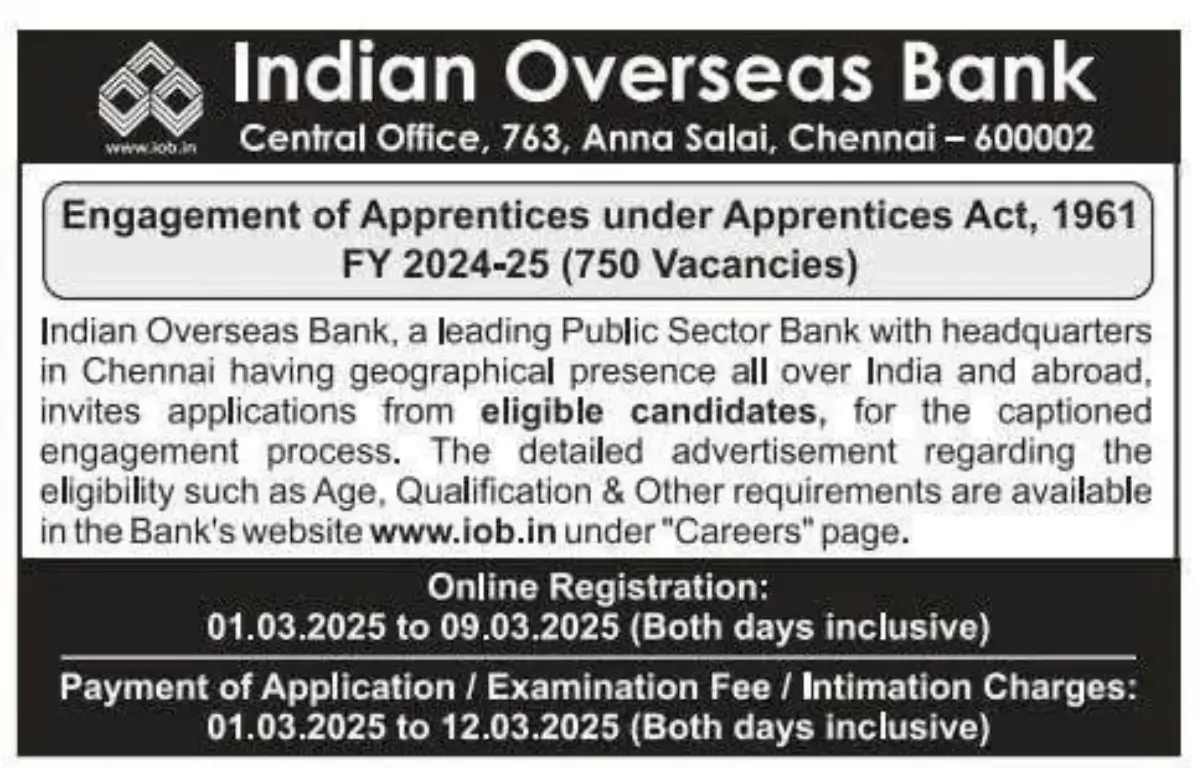

The IOB Bank LBO Recruitment is conducted periodically to fill vacancies in various locations across India. Aspiring candidates looking for a Banking Career in IOB must stay updated with the official IOB Careers page for the latest notifications.

Key Details of IOB LBO Recruitment

- Post Name: Loan Recovery Officer (LBO)

- Bank Name: Indian Overseas Bank (IOB)

- Job Type: Regular/Contractual (as per notification)

- Application Mode: Online

- Selection Process: Written Test + Interview (if applicable)

Eligibility Criteria for IOB LBO Recruitment

Before applying, candidates must ensure they meet the IOB LBO Eligibility requirements:

Educational Qualification

- A Graduate Degree in any discipline from a recognized university.

- Additional certifications in Banking & Finance will be an advantage.

Age Limit

- Minimum Age: 21 Years

- Maximum Age: 30 Years (Age relaxation as per government norms)

Experience (If Required)

- Prior experience in Banking, Recovery, or Legal Fields may be preferred.

IOB LBO Selection Process

The IOB LBO Selection Process typically involves:

- Online Application Submission

- Written Examination (if applicable)

- Interview Round

- Final Merit List & Appointment

Candidates must prepare well for the IOB LBO Exam Pattern, which may include sections on Quantitative Aptitude, Reasoning, Banking Awareness, and English Language.

How to Apply for IOB LBO Recruitment?

Interested candidates can follow these steps for IOB LBO Application:

- Visit the official IOB Recruitment Portal (www.iob.in).

- Find the latest IOB LBO Notification PDF and read it carefully.

- Click on “Apply Online” and fill out the IOB LBO Application Form.

- Upload necessary documents (photo, signature, ID proof).

- Pay the Application Fee (if applicable).

- Submit the form and keep a printout for future reference.

IOB LBO Salary & Benefits

Selected candidates for the IOB LBO Post can expect a competitive salary structure along with banking perks. The approximate IOB LBO Salary ranges between ₹25,000 – ₹35,000 per month (varies based on experience and location).

Job Profile of an IOB LBO

- Handling Loan Recovery Processes.

- Managing NPA Accounts and coordinating with legal teams.

- Ensuring compliance with RBI Guidelines on Loan Recovery.

- Assisting in Debt Settlement & Asset Management.

Important Dates & Admit Card

Candidates must keep track of:

- IOB LBO Notification Release Date

- Last Date to Apply

- IOB LBO Admit Card Release Date

- Exam & Interview Dates

All updates will be available on the IOB Official Website.

Preparation Tips for IOB LBO Exam

To crack the IOB LBO Recruitment Exam, candidates should:

- Study Banking & Financial Awareness.

- Practice Previous Year Question Papers.

- Stay updated on RBI & NPA Recovery Policies.

- Improve Communication & Negotiation Skills for the interview.

Conclusion

The Indian Overseas Bank LBO Recruitment is a great opportunity for individuals seeking a stable banking career with growth prospects. By meeting the eligibility criteria, preparing well for the selection process, and submitting the application on time, candidates can secure a rewarding position in IOB’s Loan Recovery Department.

For more details, candidates should regularly check the IOB Bank Official Website for the latest IOB LBO Notification 2024